Is there a better way to do NPD communication?

Is there a better way to do NPD communication?  Posted in: 48,Challenges- Is there a better way to do NPD communication?

Posted in: 48,Challenges- Is there a better way to do NPD communication?I think we’re always trying to figure out this whole first moment of truth, mainly because consumers really only take a few seconds to look at a package – or another way to look at it is that you only have a few seconds to really jump out on the shelf.

90% of the grocery shopping is stuff consumers always buy

A lot of people that I talk to will say they like to try new products, and I believe that because a lot of people do. But I don’t think it means every single category in the grocery store. My guess would be 90% of the grocery shopping is stuff they always buy, and then maybe to get to the chip aisle and are looking for something new, and they might slow down. But for the rest of that 90%, they’re just going to look for the normal stuff that they typically are buying. So if you have something new, it’s just difficult to jump out on the shelf.

I don’t really have an answer in terms of how we do it better other than – what we’ve been doing is trying to do it more. What I mean by that is, instead of doing one test where we’re trying to understand the first moment of truth, maybe we’re doing a couple or maybe we are bringing it earlier in the process to truly understand that.

https://embed-ssl.wistia.com/deliveries/dd8668173bc372213b6590b65721e377.mp4

Are newly emerging categories set up for success more on e-commerce versus brick and mortar?

Are newly emerging categories set up for success more on e-commerce versus brick and mortar?  Posted in: 40,Trends- What categories are more successful on e-comm than B&M?

Posted in: 40,Trends- What categories are more successful on e-comm than B&M?https://embed-ssl.wistia.com/deliveries/5eab8ba70c73beb588a6eab2abf434b5.mp4

Brick-and-mortar is developing well, but we do see shoppers from brick and mortar trying e-commerce.

We do see a big trend in planned purchases such as pet care, mother and baby, household essentials are moving into online as well.

That means that our shoppers are getting more and more used to the 20-minutes delivery – a little bit more spoiled in that sense.

How is technology making the virtual shopping method more and more sought after?

How is technology making the virtual shopping method more and more sought after?  Posted in: 39,Innovation- How is tech making virtual shopping more sought after?

Posted in: 39,Innovation- How is tech making virtual shopping more sought after?https://embed-ssl.wistia.com/deliveries/615ab86917b28b75ab230ca92f3c5a12.mp4

Over recent years, we at EyeSee have been experimenting with a series of possibilities in terms of 3D stores and virtual shopping. The idea was to always immerse the consumer into a realistic context. The unique component for this study with Google has been the fact that we have been integrating video content into another video of the merchandise fixtures. We make our 3D stores very agile in terms of setup, so the experience for the respondents becomes very shoppable.

It’s important to think pragmatical when we are configuring the study – so we must always balance the granularity of the environment.

Some components we develop in 2D with a bit of depth versus some other objects that we are studying, we fully develop in 3D. Ultimately we love to understand not only the shopping behavior but whether we can generate any level of emotional response as a trigger to that shopping experience. That’s not only important for companies like Google but just imagine what that would be like in luxury and retail for cosmetics and beyond!

What are some of the newly emerging e-commerce advertising tools?

What are some of the newly emerging e-commerce advertising tools?  Posted in: 38,Tools- Which e-commerce advertising tools are emerging?

Posted in: 38,Tools- Which e-commerce advertising tools are emerging?https://embed-ssl.wistia.com/deliveries/98cd94c5ed01de829b75162d2845d2ff.mp4

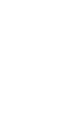

One of the impactful advertising tools that has been recently launched on Amazon product list pages is enhanced Branded Content that adds features to the customer experience with interactive design and innovative features.

Customers are staying longer on the page, and the attention span is longer due to the interactive elements – they focus more on the features that help them understand a bit more about the product before they decide about purchasing it. More customers reach the end of the page with this EBC++ content than when looking through static images and text, as on the regular PDPs. Also, we have found that EBC++ drives sales up to 44% –

adding to the basket is more likely to happen when interactive content is present on the PDP.

Another important tool is interactive Q&A and comparison table. These features drive the highest interaction, likability, and future usage. On average 1 in 10 users interact with any of the features. However, if there are more different types of interactive features, the number goes up.

How have the changes in consumer behavior impacted the process of NPD?

How have the changes in consumer behavior impacted the process of NPD?  Posted in: 47,Trends- How did changed consumer behavior impact the NPD process?

Posted in: 47,Trends- How did changed consumer behavior impact the NPD process?https://embed-ssl.wistia.com/deliveries/517aa0f25bef621225661410ecabd071.mp4

With new product development, the difficult thing is that

+80% of new products fail

And while our processes changed some, because of changing consumer habits and the pandemic – really over the years, it’s just changing because when 80% of the products fail, you’re always trying to do better. So I think every company is really trying to improve their new product process and get better at it. For us,

what it really comes down to is just to better understand consumer habits, what are their wants, what are their needs

– and doing a lot of research around there to understand those habits along with just learning how to better communicate at the first moment of truth and how do we do better from a marketing support standpoint.

How did the pandemic impact your strategies for new products?

How did the pandemic impact your strategies for new products?  Posted in: 25,Innovation- How did the pandemic impact new product strategies?

Posted in: 25,Innovation- How did the pandemic impact new product strategies?https://embed-ssl.wistia.com/deliveries/ba4fb75e9c8601a21cb0dc0085627585.mp4

Because many of the occasions have changed, we switched more from “away from home” to “at home” consumption – so the atmosphere, the energy, the context of consumption of our brands has changed. When we’re talking about the new product, consumers are more willing to try the new product.

Consumers are definitely in a position where they want to explore new products and try different types of categories.

According to some data in Europe which we have, we know that in, for example, Germany, 72% of total consumers of the age of 16 to 34 are willing to try new exotic flavors – that’s 65% in France and Spain. Among those flavors, they would like to try some of them that they’ve never tried, so they can kind of transform themselves to the areas of the world they are now not able to travel. Knowing that we at Coca-Cola definitely we’re thinking about some exotic flavors that we can offer to our consumers to satisfy that need. COVID-19 also brought the overall health concern – so now consumers are looking at the drinks and foods as a vehicle for better health. Functionalities are getting more traction and that is something that we are paying attention to. The consumers are also looking to support as well – they are interested in immunity, boosting their energy, improving gut health and concentration, managing the mood, and many other products features out that were not so typical prior to COVID-19.

How do you measure consumer needs when the new ways of life impact research quality?

How do you measure consumer needs when the new ways of life impact research quality?  Posted in: 24,Challenges- How do you do research in a changing world?

Posted in: 24,Challenges- How do you do research in a changing world?https://embed-ssl.wistia.com/deliveries/1f1a967b799c6be4ff25592802591b88.mp4

In France, we were glad to test the virtual in-store shopping test capabilities provided by EyeSee – which proved to be especially useful when retailers closed shops. This allowed us to conduct marketing tests on Chromebook as initially planned with no interruption.

In the summer, we experienced a slightly normal period when the [COVID-19] situation improved. We re-started to use traditional methodologies like quantitative and qualitative interviews – if safety conditions (like social-distancing) were respected for both vendors and users.

The new challenge was: how to detect the long-term trends and shopping behaviors that will remain after COVID-19?

We started to implement long-term trackers and identified opportunities to use the time series necessary to develop predictive models. We are still experimenting, but we should see the result in a couple of months!

How did virtual stores help extract smart learning about multiple elements that make up the in-store purchase experience?

How did virtual stores help extract smart learning about multiple elements that make up the in-store purchase experience?  Posted in: 23,Tools- How do virtual stores give insights into the in-store experience?

Posted in: 23,Tools- How do virtual stores give insights into the in-store experience?https://embed-ssl.wistia.com/deliveries/ffefd6c97f0045ee97f7d34ce66b9616.mp4

The first step was to recreate an existing laptop area in 3D. We also modelized our 3 different table setups to incorporate them into the 3D store.

Everything was reconstructed in detail to recreate the full in-store experience – from the table shapes to each laptop and even stickers.

In the second step, we recruited respondents to a 25-minute experience on their own laptop, and thanks to the virtual stores, we were able to follow them during the whole in-store purchase experience: First, they began with the eye-tracking part. Respondents were invited to watch the video of the 3D store and to look anywhere they would like as if they were in the real store. The aim was to measure where they looked at, for how long, and in which order to drive conclusions about Chromebook brand visibility. We then asked them questions to measure spontaneous brand awareness & recall. Then, they entered the click tracking task. Respondents were invited to interact with the tables. They were asked to click on anything they found interesting on the table. As everything has been modelized in 3D, they could explore each communication element, such as product stickers or even play videos. Clicks were recorded to measure interaction during this experience. In the end, they were exposed again to each communication element and then answered a regular questionnaire about Chromebook and table elements. It allowed us to measure product understanding.

Have you noticed that some sustainable product claims perform better than others?

Have you noticed that some sustainable product claims perform better than others?  Posted in: 37,Trends- What sustainable product claims perform better?

Posted in: 37,Trends- What sustainable product claims perform better?https://embed-ssl.wistia.com/deliveries/0caf36851a921ddd79f5f2296c8b14b7.mp4

Yes, absolutely. The work that you did around the space was really insightful and pretty consistent with what we see as well.

One of the key best practices that we have is really keeping it simple – in sustainability and manufacturers were living and breathing this all day long, and we can get a little bit technical as we think about describing the claims and talking about the different sustainability processes and benefits. But at the end of the day, the reality is – somebody is standing at the shelf in a store or online. So, we just want to be simple, clear, intuitive, and easy to understand.

One of the best practices is pulling away some of the jargon and really being crystal clear and telegraphic about what the claim actually is.

That said, we also want to make sure that it’s easy for people to learn more, so part of the challenge is greenwashing, and rightfully so. As a brand, how can we give them an opportunity to learn more? One way that we’ve done this is to put a QR code on the pack after your crystal clear, easy-to-understand claim. People can click into the QR code and go and learn more, whether you’re talking about being made in a plant with renewable energy or being made with 100% recyclable plastic.

How important is adequate category knowledge to interpret Decision tree outputs?

How important is adequate category knowledge to interpret Decision tree outputs?  Posted in: 46,Tools- Is category knowledge essential to interpret the Decision tree?

Posted in: 46,Tools- Is category knowledge essential to interpret the Decision tree?https://embed-ssl.wistia.com/deliveries/a2e5282a7ed8241019dee6e6b3877704.mp4

With a decision tree output, its beauty is in the simplicity of it – it really helps you and your stakeholders make sense of all of it at a glance. As you go down the diagram, you discover new and deeper info and you begin to understand how consumers discern between products, even if it doesn’t fully align with what is on the shelf or your ingoing assumptions. Of course, the most important output is the behavioral decision tree which shows the behavioral importance of the product attributes.

Another valuable output that can be included is one I’m almost as excited about as the behavioral decision treemap itself. Our Brand Gain & Loss Analysis can tell you the proportion who switched from your brand to Competitive Brand X, etc., and when or who switched from Brand X to your brand and when. We can outline the 4 different types of shoppers, but this is even more granular and can show you where and to whom repertoire or loyalties lie. We also include the stated importance of the attributes, brand recall, dominant occasions, and missions, as well as ease of shopping and shelf organization.

So, you get a 360-degree view of the shopper and the shelf by using both implicit and explicit methods in a single study.

What are the key success factors in Asia when distinguishing between online platforms?

What are the key success factors in Asia when distinguishing between online platforms?  Posted in: 26,Trends- What are Asia’s advances regarding online platforms?

Posted in: 26,Trends- What are Asia’s advances regarding online platforms?https://embed-ssl.wistia.com/deliveries/3b733a28f58a4cc5a227ffd571e55a72.mp4

Broadly speaking, there are two different facets to this.

There are different considerations for different products, but one thing that cuts across is the selection of things, access to all these brands, and the variety to purchase.

The selection is always going to be one of the top reasons why I would come and buy on your platform. The second aspect would be pricing: offers, deals, sales. Delivery time is also important, but it is more prevalent for folks in the metro areas who have access to a hyperlocal delivery system.

People definitely want things right here and now – that majority is coming from the metro population.

What are the key factors to having successful innovations?

What are the key factors to having successful innovations?  Posted in: 12,Trends- What is key to having successful innovations?

Posted in: 12,Trends- What is key to having successful innovations?https://embed-ssl.wistia.com/deliveries/93bf019f294dc5bcbcab5770f040962f.mp4

If I’m thinking about the industry in which we operate, there are 2 factors that are the key reasons for success.

- One is – if a small innovator is providing a better or a different quality of a product, service, or a special feature, then they can apply premium positioning and pricing strategy.

- On the other side, if they don’t have a better quality of a product or premium pricing, they tend to provide better convenience while shopping or while experiencing and using the product at a better price, which means a lower than the average product price in that category.

How should brands employ social media to create a positive association with acting greener? How does Colgate do it?

How should brands employ social media to create a positive association with acting greener? How does Colgate do it?  Posted in: 11,Challenges- How can social media impact greener behavior?

Posted in: 11,Challenges- How can social media impact greener behavior?https://embed-ssl.wistia.com/deliveries/b0591d7dcbd55190c79dbe8b6028509c.mp4

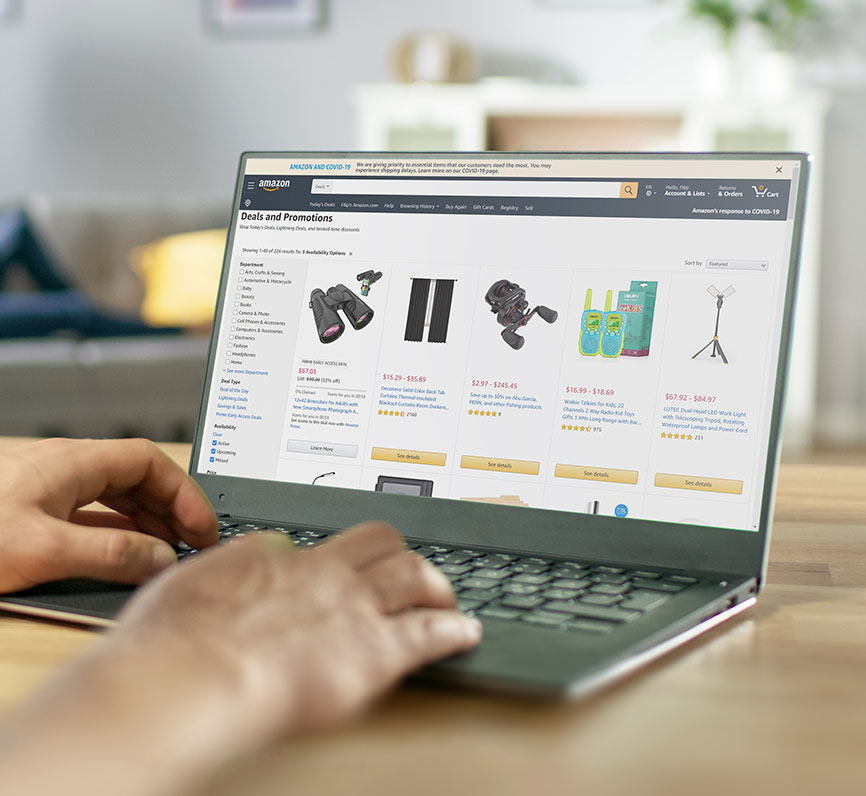

One of the things that we do is really use social media to help us amplify our voice – and not only talk about what we’re doing as a brand but also

help people spread the word and spread sustainable ideas amongst themselves.

One example is Tom’s Of Maine – this is a brand in our portfolio that’s very dear to my heart. They do an excellent job with social media and using it not only to drive energy and excitement for what we’re doing as a brand but also provide an opportunity for our brand enthusiasts to build momentum amongst themselves and talk about what they’re doing in a sustainable world. They can share their tips and tricks, showcase some of the things that they might be doing along with the brand or separate from the brand to help drive sustainability and messages home.

I think it’s a really great example of how we leverage word of mouth to drive credibility but also to continue the enthusiasm around the sustainability topic more broadly.

Why is it so important to test behavior in context?

Why is it so important to test behavior in context? Posted in:

22,Tools- Why is it crucial to test behavior in context?https://embed-ssl.wistia.com/deliveries/2d61d80cd49de513d63e2876700c0c23.mp4

I would say the ability to build a lifelike experience for the respondents and have a fully experimental design that you can control is the greatest advantage of using behavioral, contextual studies. They provide very high ROI since they allow for so much experimentation, testing iterations, validating your assumptions with real respondents in a natural setting while capturing the implicit unbiased behavioral measurements.

We have a team that works hard to create cutting-edge environments and protocols for any kind of testing you can imagine – new industries, new consumer experiences, but also new ways of testing staples like packaging, advertising, and NPDs. Another thing I’d like to point out here is thatwe love to build behavioral versions of things that were usually tested without this essential dimension.

As we grow, tech will continue to be one of the areas on which we spend the most

time focused on as a company.

What are some of the main reasons for new product failures?

What are some of the main reasons for new product failures?  Posted in: 36,Challenges- What are the main reasons for NPD failures?

Posted in: 36,Challenges- What are the main reasons for NPD failures?https://embed-ssl.wistia.com/deliveries/dfad95dfbe4f7daa4623e0a0dfc91de7.mp4

Whenever you have an 80% failure rate, you are going to have a lot of reasons why something is not working. The four reasons I’ve seen why innovation doesn’t always work are, firstly, just understanding consumer behavior.

The second one is in product development, and the third one is in communicating the product or the first moment of truth. And finally, in marketing support – which I don’t have a lot of experience in because I am not a marketing person, but I do see a lot of issues there. I think we sometimes try to get more information out of consumers than what is realistic. When you show the consumers a concept or a product, or a package, it’s pretty easy for them to say that they like it or if they don’t. What is really difficult is questioning beyond that – such as ‘when do you think you would use this product’ or ‘who would use this product’, ‘how do you think it is going to taste’ – some of these things are difficult to really understand because sometimes we get good answers, but sometimes we don’t – and so I think we expect a bit too much.

Another big thing is the whole ‘do-say’ gap of what consumers say versus what they do, so what I try to do to build empathy is putting myself in consumers’ shoes about the questions we are asking.

How should brands prepare for the e-commerce first world?

How should brands prepare for the e-commerce first world?  Posted in: 45,Trends- How to prepare for the e-commerce first world?

Posted in: 45,Trends- How to prepare for the e-commerce first world?https://embed-ssl.wistia.com/deliveries/50954a5d0cf2c1574d37bce06ac05889.mp4

For me, quick commerce is the space to go. It is very different from e-commerce, but it is a version of it that is much quicker. Instead of next day or 24 hours delivery, we will deliver within 20 to 25 minutes.

That’s the concept of Quick commerce – that is the space to grow, especially for impulse brands that do not thrive as much in the e-commerce sphere

– categories such as snacks, beverages, alcohol but also more planned purchases such as diapers, household, milk formula, etc. – they’re all growing as we speak. We do see that alcohol, snacks, beverages are more of an impulse purchase and not thriving as much, so I feel that quick commerce is the way to go.

Do companies who have digital in their DNA have an easier time adjusting to new research methods?

Do companies who have digital in their DNA have an easier time adjusting to new research methods?  Posted in: 27,Challenges- Are some brands adjusting better to new research tech?

Posted in: 27,Challenges- Are some brands adjusting better to new research tech?https://embed-ssl.wistia.com/deliveries/e01834f7f763f4a45a8c88d6a8da5e26.mp4

Research is a large name covering many diverse fields. Today I can provide you with a POV on the marketing and ads research that I developed for Google: our mission is to generate actionable insights that put the user in their context at the heart of business decisions.

As our users’ behaviors have evolved over the past years and have become more complex, innovating is definitely key to developing actionable insights.

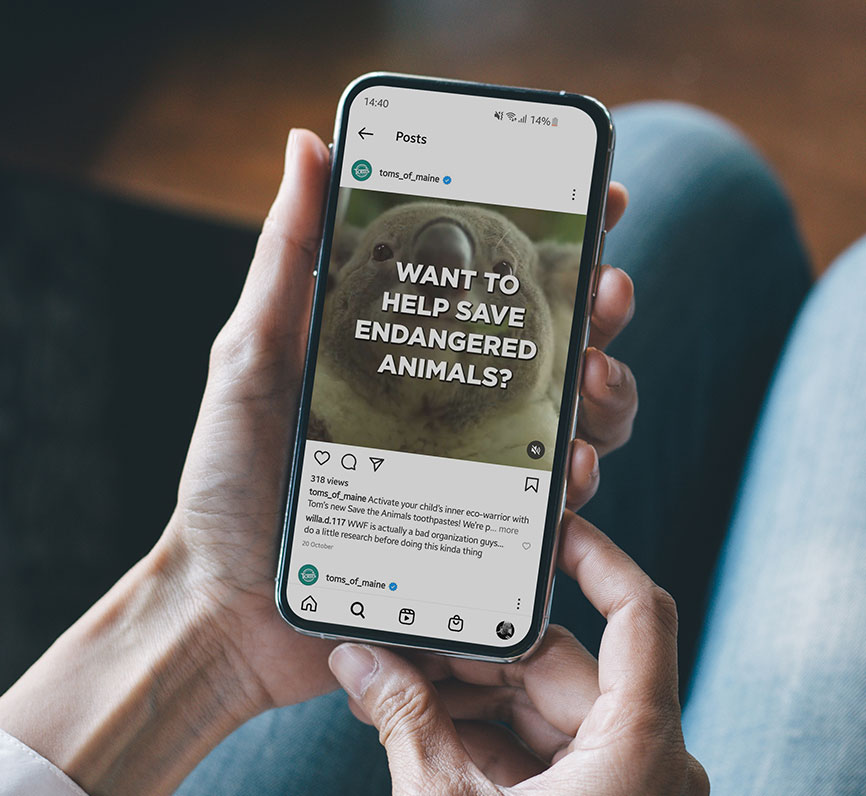

You can create innovation at every step while respecting user privacy and vendors safety: it can be about opening new areas of thought, challenging well-known marketing frameworks (like rethinking the purchasing behaviors – aka the Messy Middle – through behavioral science), testing new methodologies to improve our operational marketing (like the virtual shopping capabilities created by EyeSee). But how do we do this? It is important to create a space for innovation by partnering and brainstorming with many diverse research companies, from startups building experimentations to large and well-known research companies established in many countries. It is an interactive process as we can also share best practices or new methodologies with our vendors or research guidelines created by our researchers (like sharing UX requirements for mobile questionnaires) to improve research quality.

Why is virtual shopping the MVP of market research?

Why is virtual shopping the MVP of market research?  Posted in: 13,Tools- Why is virtual shopping the MVP of market research?

Posted in: 13,Tools- Why is virtual shopping the MVP of market research?https://embed-ssl.wistia.com/deliveries/85e271b46123214759e30000d0256deb.mp4

We conducted a meta-analysis to understand how different are the results for virtual shopping and behavioral methodology compared to a traditional approach of a Purchase Intent Scale. Based on this, we wanted to validate recommendations based on a simulated environment that has better use for our clients. The simulated environment for us means that our respondents are not in isolation but in a clear social media feed.

The way we will rate packaging is not only in a standalone mode but in a very close to real shelf situation in-store, with its competitors surrounding it.

Finally, our respondents are not only answering survey questions but have to make a shopping decision on the spot. That is the essence of the way we do research. Knowing this, virtual shopping can also help us satisfy our researcher’s curiosity and answer broader questions, for example, about the different KPIs we use in other methods. It is a type of reality check, a way to compare other findings or behavior that is strongly grounded in reality.

Should brands revise their strategy based on insights that are a product of the zeitgeist?

Should brands revise their strategy based on insights that are a product of the zeitgeist?  Posted in: 04,Challenges- Should brands revise strategy based on product insights?

Posted in: 04,Challenges- Should brands revise strategy based on product insights?https://embed-ssl.wistia.com/deliveries/f1ebdc2861efa600b6545848865ce4ca.mp4

Once you get into strategy with some depth, you realize that there are different ways in which consumer insights can be leveraged – some are more strategic and some more tactical or opportunistic. We acknowledge that there are different types of insights, and part of understanding what you’ve got when you have an insight is understanding what it’s really useful for. That depends on a number of factors, contextual factors too. So whether insight is relevant depends on the context into which you are trying to create communications, change consumers’ or brand’s behavior. The issue with strange periods like COVID-19 or Black Lives Matter is that the gauges of relevance become skewed in the short term. For example, during the pandemic, there was a lot of advertising that looked and felt the same. One of the things that happen in those circumstances is that insight that feels like they are very relevant at the moment turns out to be very generic and not particularly relevant.

That’s where smart marketers need to do a combination of things and remind themselves what’s really at the heart of their brand, business, and consumer.

They have to stick to the kind of consistency that their brand has in its industry and marketplace and take a step back and observe. The experience will tell you when a situation is volatile and not conducive to making those decisions. A precious few companies seem to be able to rein that in during COVID- 19 in 2020.

What can US and European e-commerce platforms learn from Asian ones – are they the harbingers of what is coming?

What can US and European e-commerce platforms learn from Asian ones – are they the harbingers of what is coming?  Posted in: 10,Trends- What can e-comm platforms learn from the APAC region?

Posted in: 10,Trends- What can e-comm platforms learn from the APAC region?https://embed-ssl.wistia.com/deliveries/0a9459e9c1329c22fe407c5a34c92d4d.mp4

Regions such as APAC are definitely moving stronger in quick commerce. Categories in quick commerce are more impulsive, while in e-commerce, they are more long-tail planned, the range is much wider. You would buy your television on e-commerce, but on quick commerce, you would go for a shorter delivery time.

So yes, the US and Europe are evolving into a more long-tail, wider approach, while

I do see Asia as always coming up with ideas first, testing them out, and then these trends move to Europe and US.

The US tends to pick it up faster than Europe, but this time with quick commerce, we see some European players picking up the concept slightly faster than the US. APAC is always first in discovering e-comm trends, and that’s why I am super excited to be in this location, at the heartbeat of the changes.

What are some lessons learned over the years – when it comes to NPD?

What are some lessons learned over the years – when it comes to NPD?  Posted in: 35,Innovation- What are some NPD lessons learned over the years?

Posted in: 35,Innovation- What are some NPD lessons learned over the years?https://embed-ssl.wistia.com/deliveries/cac742b82552c45ffaf38259eae5306f.mp4

There are a number of lessons that I’ve learned over the years in innovation – one being that

people just seem more comfortable and more honest when they are in their own house.

They have an easier time admitting that maybe they had a chocolate donut for breakfast, or that they have chips sometimes in the afternoon, or that maybe they don’t always read the nutrition facts on the back of a package.

They are more comfortable and it seems like just our insights are just a lot better.

So, that’s one of those things that I’m definitely going to be carrying forward.

Which parts of the online path to purchase will change the most as e-commerce for FMCG continues to rise?

Which parts of the online path to purchase will change the most as e-commerce for FMCG continues to rise?  Posted in: 14,Trends- What will change in the online P2P future?

Posted in: 14,Trends- What will change in the online P2P future?https://embed-ssl.wistia.com/deliveries/8612cce50174a35c857c6b5bde523f23.mp4

We need to think about several phases of reaching the consumer: Start with awareness, evaluate, and move to bonding and advocacy. It depends on the level of development and your strategy for a specific country.

An e-commerce platform will give you an opportunity to focus on the evaluation and the buy. However, every single of these pillars is evolving, and their lines are getting blurred. For example, in China, there is no traditional ‘path’ – everything is faster, and the content needs to come to the consumer. We are moving from mass targeting to deep and sole targeting.

I think things will move most in terms of the experience. How can you give something intangible, such as the taste of the product, through a digital experience?

I think in the next couple of years, this is where we will provide something that is exciting. I don’t know which technologies would enable this, but I think it is something that has the potential to really influence the way consumers shop.

Is there something smaller innovators are leveraging that the big companies are missing?

Is there something smaller innovators are leveraging that the big companies are missing?  Posted in: 05,Challenges- What are smaller innovators leveraging more than big companies?

Posted in: 05,Challenges- What are smaller innovators leveraging more than big companies?https://embed-ssl.wistia.com/deliveries/b32b5c0f72aa52fa1e818f5bca8e8647.mp4

Small innovators, small disruptors will keep on popping up and teaching all of us important business lessons. We at big companies tend to think big – immediately provide a wide portfolio, go into the big campaigns and cover many touchpoints, wide formats, and occasions.

And the beauty of small companies is exactly the opposite – the beauty and the reason they are so successful is that they are not obsessed with the economy of scale. They are forced to be small for a while and to act niche, but that is the key reason for their success – and there is a lot we at big companies can learn from them! And we are learning each and every day!

There is beauty in the interaction between big and small companies because we are exchanging knowledge and experience

and we are learning from each other because both small and big companies have their pluses that we can all benefit from.

How can brands approach testing NPDs?

How can brands approach testing NPDs?  Posted in: 01,Tools- How can brands approach testing NPDs?

Posted in: 01,Tools- How can brands approach testing NPDs?https://embed-ssl.wistia.com/deliveries/7f46eeec5ef5e346e31b55dcb6d00034.mp4

What we are trying is to follow clients’ processes, especially the stage-gate innovation cycle, and support the decision making. From the ideation phase to the final execution on the market, we are equipped with different behavioral tools and metrics, both measuring System 1 and System 2. With some clients, we are involved from the very beginning. Some clients need a disaster check, and some primarily ask how to improve the product. Together with our Tech & Design Teams, we developed an Online and Virtual Shopping Lab where we simulate typical shopping situations and measure shopping behavior. Thus, we’ve come to a moment of truth. The tool is very flexible, enabling different modifications in the designed context and at the same time conceived to provide strict control over important behavioral drivers – here, we have an experimental design. It allows us to test different scenarios and confirm that the shopper is recognizing something on the shelf as a novelty.

We are embedding store walk-through, introducing different POS materials, varying different placements, planograms, and types of displays while at the same time sales potential of the new product is measured.

We are repeating purchases and sometimes expose shoppers to out-of-stock situations to identify what are the risk of listing new SKU.

How should companies use behavioral research on social media to make data-driven decisions?

How should companies use behavioral research on social media to make data-driven decisions?  Posted in: 03,Innovation- How can companies use behavioral research on social media?

Posted in: 03,Innovation- How can companies use behavioral research on social media?https://embed-ssl.wistia.com/deliveries/dba133000210a1bc7feb45bd2c454758.mp4

The question often is now what? That’s the kind of a question you need to ask yourself as a marketer with any kind of insight or research: what can I do with this? It’s something that I almost find difficult more than the research itself – how do I find the way to use this usefully? Ultimately, what you should do as a company is to say what does this tell me about my core objectives and business goals.

For me, marketing is a subset of business, communication, and media goals, etc. If you want to find out how does this help, go back to big questions and big issues you were trying to address as a marketer and what does this tell me:

either to confirm that those were the right issues or to contradict,

give me a new insight in terms of how I relate to the target audience, how they think and feel about my brand, etc. Relate back what you learned to what you are trying to do in your marketing efforts.

What type of posts draws positive emotions that impact engagement – what should brands focus on?

What type of posts draws positive emotions that impact engagement – what should brands focus on?  Posted in: 09,Trends- What posts draw positive emotions that impact engagement?

Posted in: 09,Trends- What posts draw positive emotions that impact engagement?https://embed-ssl.wistia.com/deliveries/a493d0808ba9991a27526fe89909a7ba.mp4

The overall asset of engagement is made of emotions, so if you want to evoke emotions – don’t be scared to push the envelope and be creative. Things that relate to positive emotions are being sincere, honest, showing warm messaging with witty copies and images, footage of animals, depictions of sports and activities. Even more than this – talking about relevant topics and communicating that we as a brand stand against discrimination and racism to contribute to the cause in this way. Showing a variety of race and cultural diversity is the key.

The biggest takeaway for Black Lives Matter and COVID-19 posts is that they can be more impactful than emotional and supporting posts for brands.

Think about meaningful ways to address the crises in a less generic way and more humble, human, and relatable way to your audience. Emotional images can often be less personally relevant due to the use of generic photos, motivational quotes, etc. On the other hand, seasonal and tactical posts perform the worst in terms of emotions – they are the least innovative and most branded content encountered on social media. However, Seasonal and tactical offers are the easiest to understand, and Tactical posts have the long retention power explaining the rules of a giveaway or course of action that needs to take place.

What was the role of behavioral methods in getting value out of the data?

What was the role of behavioral methods in getting value out of the data?  Posted in: 21,Tools- How do behavioral methods extract valuable data?

Posted in: 21,Tools- How do behavioral methods extract valuable data?https://embed-ssl.wistia.com/deliveries/70af9cf9023d3e9a4ae4dc73f14faaa0.mp4

This is where EyeSee comes to life for me – I love the fact that we could look at where the people’s eyeballs were looking on the page, we could get their engagement of what they click on as areas of interest, and then tie all of that together with a customer survey that goes on top of that. To be able to really utilize these three big bodies of information, we can understand on any given page are consumers even seeing the pieces of real estate that are on the page; if they see it, do they even care about it. We actually had one element on the page that was really passionate for us on our product description page, and we put a lot of value.

We found that only 34% of people saw what we were putting on the page, and of those, only 2-4% were clicking on it.

So it was a huge revelation for us as well. We were able to target some of those quantitative questions to gauge do consumers even care about this, maybe that’s why they are not looking for it, perhaps that’s why they are not seeing it. Being able to go at the research from those three areas is super valuable.

How important are behavioral and implicit data in your decision-making?

How important are behavioral and implicit data in your decision-making?  Posted in: 15,Tools- How vital is implicit data in your decision-making?

Posted in: 15,Tools- How vital is implicit data in your decision-making?https://embed-ssl.wistia.com/deliveries/7ee918a1d06a8dd152324fc77212dfe5.mp4

The biggest single long-term change that data and research provides should embrace is a move from explicit to implicit data.

Relying on or putting faith in claimed purchase intent is like a habit that the industry won’t shake off. Those metrics are so poor and so poorly validated that even as directional metrics, they are of such little use and so outdated. I understand

it is not easy to move every metric to implicit right now, but I am a big fan of those that are trying to do

and of clients that embrace the effort to move forward with methodologies where consumers don’t know what you are asking them and are not preprogrammed and biased to a certain way, which you see all the time in sorts of explicit research.

Given the increasing conversation on climate change, have you noticed any emerging consumer trends?

Given the increasing conversation on climate change, have you noticed any emerging consumer trends?  Posted in: 02,Trends- What are the emerging sustainable trends?

Posted in: 02,Trends- What are the emerging sustainable trends?https://embed-ssl.wistia.com/deliveries/a4b470d732155aace1af78b69bab808a.mp4

First of all, I think climate change has really become much more tangible. In the past, we’ve heard it as something that seemed a little bit fuzzy, a little bit vague, maybe something that would impact the next generation. It didn’t feel as real or here and now as it does today. Two big trends have emerged.

- The first is urgency. People have a significant urgency to take action. We see this not only because people are seeing the good, cleaner air and skies, especially through the early days of lockdown, but also because they’re seeing the bad. I heard from so many consumer interviews that through COVID, it suddenly became very apparent to them how much trash they produce as an individual and a household. In the pre-COVID world, your trash on any given day would be spread between home and the office, school, restaurant, and gym, etc. And all of a sudden, we’re in lockdown, and every bit of trash you create is sitting in the kitchen trash bin – that was a very rude awakening for people, and it really helped drive an urgency to take action.

- But the second trend is that consumers are feeling a little bit stuck. People just aren’t sure where to start, and that really helps us think about what we can do as a manufacturer to make sure it’s easy for people to be unstuck.

Which topic can brands tackle by leveraging the Online Path-to-Purchase solution?

Which topic can brands tackle by leveraging the Online Path-to-Purchase solution?  Posted in: 08,Tools- What can brands tackle with the Online P2P solution?

Posted in: 08,Tools- What can brands tackle with the Online P2P solution?https://embed-ssl.wistia.com/deliveries/c2f8de2451b4ac71483f5346465ac3d0.mp4

The majority of the client questions can be summed up into three topics: the first and the broadest is the situation when the client knows a lot about brick-and-mortar shopping but wants to know more about online shopping patterns for the specific category. The second topic is more concerned with the client’s product presentation on the retailer website – can shoppers find the particular product? The last category refers to more specific and tactical questions that focus on the product performance once certain changes are implemented. When we explore how the category is bought online, we start with our navigation tracking approach: this tool unravels the spontaneous behavior on the retailer’s website.

As for the product presentation on a retailer website, usually meaning its visibility and overall findability, we use a combination of methods.

We use both navigation, eye and interaction tracking – navigation helps us uncover how much time and effort shoppers invest in finding a particular product that usually clients want. Eye tracking gives us an additional perspective on how noticeable that product is on the retailer’s list. When it comes to more specific questions, considering the impact of different optimizations, we rely on the eye and interaction tracking that identifies key conversion triggers in this optimized context – how each of these introduced features affects a purchase intent and to what extent.

Is the supplier-client relationship different now than it was a year or two ago?

Is the supplier-client relationship different now than it was a year or two ago?  Posted in: 34,Trends- Is the supplier-client relationship different now?

Posted in: 34,Trends- Is the supplier-client relationship different now?https://embed-ssl.wistia.com/deliveries/71010d434f06838679a1cf02f85782e6.mp4

In North America, the market for research, data, and analysis has never been more vibrant and more evolving, and one of the things to remember is that clients don’t want to renew their research relationships every week, every month, or even every year. What clients are looking for is relationships with research providers, which allow them to consistently deliver good consumer understanding to their business without having to renew it and refresh it all the time. That puts pressure on research companies to evolve without being pushed to. The providers that I was most inspired by are always the ones that brought changes to me and treated is as a partnership. In client-agency relationships presenting and visualizing data often gets neglected and left up to the clients to think about how they want to visualize it internally, and some clients like that degree of control; it’s crazy not to share an agenda for how data is presented, especially to people who don’t deal with data every hour of every day. So for me, that was always a very big deal –

How can we get better at showing data? Data that can be easily understood can also be easily leveraged and used – and it was always a big deal.

How can companies achieve staying consistent with the brand – and still be a part of all the conversations that are relevant to consumers?

How can companies achieve staying consistent with the brand – and still be a part of all the conversations that are relevant to consumers?  Posted in: 28,Challenges- How can brands be consistent and a part of relevant conversations?

Posted in: 28,Challenges- How can brands be consistent and a part of relevant conversations?https://embed-ssl.wistia.com/deliveries/9922dfa13a51299298c6f29c2e8a560b.mp4

The more relevant question is – should you be part of that conversation or not? What we’ve seen during COVID is that in the beginning, every brand was saying the same thing: we understand these are difficult times, but here’s how are cookies, cars, or hand lotion is the best solution under these current difficult circumstances. It just doesn’t make sense – consumers are very smart and educated, and they’ll pull through that very quickly. In fact, I believe it can become counterproductive because you can get the ridicule of consumers, and you become a hashtag or something like that.

What we’ve learned from the research is that if you can find that natural, logical place that makes sense at that moment and the consumer can relate to who you are in that moment – then it makes perfect sense to do that.

It can enrich and enhance communication because it can actually make you more relevant and make you stand out from the competition. But if the opposite is true, when it sort of feels dragged into it, not relevant and kind of virtue signaling, consumers are not going to buy into that. They know when they’re being taken for granted or taken in a direction that doesn’t make sense. The best-case scenario is that they’ll make fun of you for 15 seconds on Twitter, or, in the worst-case scenario, you will have to pull ads and do all sorts of other things. Be very careful and find the natural interaction with it.

How do you create space for innovation?

How do you create space for innovation?  Posted in: 16,Innovation- How do you create space for innovation?

Posted in: 16,Innovation- How do you create space for innovation?https://embed-ssl.wistia.com/deliveries/84b0654d3d38dc187d57d7058a9560de.mp4

It’s very important to create a space for innovation by partnering and brainstorming with many diverse research companies – it can go from a startup building experimentations to very large and well-known research vendors in many countries.

It’s like an interactive process as we are always happy to share best practices and new methodologies with our vendors, research guidelines, and UX requirements for mobile questionnaires, for example, to improve research quality.

We love to work with different vendors and people because we are convinced that diversity favors the appearance of new ideas and methodologies. Of course, not all ideas succeed in the short term because innovation takes time, and you can fail, but that’s okay. As marketers, it is on us to choose where to put the cursor of innovation.

Is there something big companies can learn from smaller ones?

Is there something big companies can learn from smaller ones?  Posted in: 06,Tools- What can big companies learn from smaller ones?

Posted in: 06,Tools- What can big companies learn from smaller ones?https://embed-ssl.wistia.com/deliveries/31efa7261e524ded728dc4aa4568b548.mp4

Many things. First of all – the agile approach is something that we as a big system could not say was one of our key advantages in the past. We are heavily learning from small companies and are now applying many agile principles in the way we operate. Uncertainty is something that is an everyday situation that small companies are managing.

For us, being big, we were trying to remove uncertainties – but now we are learning how to accept it as a way of doing business and dealing with it each and every day.

Many small companies have a super-efficient and authentic vision and mission with a purpose – which when you are big and with a wide portfolio means you need to cover the needs of a different part of the business so you can not be so focused on the vision and mission. Then there is high engagement internally among the employees and externally, especially with the consumers. Something which they can be really proud of, and we are learning from them and trying to apply consistent interaction with their consumer and basing the business model on that interaction. And finally – alternative channels. Big companies usually tend to go to the mainstream channels to distribute products there, while smaller companies are trying to go the other way around and plug into the alternative channels to build the brand and the product there.

Is it wise for advertisers to address polarizing issues on social media platforms?

Is it wise for advertisers to address polarizing issues on social media platforms?  Posted in: 07,Challenges- Is it wise to address polarizing issues on social media?

Posted in: 07,Challenges- Is it wise to address polarizing issues on social media?https://embed-ssl.wistia.com/deliveries/1f466dc71650c6df9f58d05c8ae0be6a.mp4

With all the issues the world faced over the last years, it has proven to us that we all need to work together. And working together is about attitudes. It’s about a behavioral change in attitudes – there’s one big industry that is all about that, and that is advertising. Brands spend more than 315 billion a year in the US trying to change consumer behavior and people’s attitudes. So, what if they can take a small part of that and try to accomplish both a return on investment on advertising and create big social impacts for society. This is nothing completely new. Since the early 2000s, many companies have spent a lot of money on CSR campaigns – from addressing greenhouse gas pollution to LGBT issues and Black Lives Matter. But the question nowadays is, “how far do you want to go as a brand?”. You don’t have to address them all, but pick your battles and do it in an authentic way. It’s all about learning. If brands are convinced about their purpose, they will need to learn.

One of the best ways to learn is by experimentation and doing research.

You try something out in controlled environments, measure it and learn from it, try out something new, learn from it and then release it. That’s what research is all about.

How does General Mills approach the innovation process?

How does General Mills approach the innovation process?  Posted in: 20,Tools- How does General Mills approach the innovation process?

Posted in: 20,Tools- How does General Mills approach the innovation process?https://embed-ssl.wistia.com/deliveries/60d314fd1672a9eccc9a4af84ac2e5f8.mp4

I would say we really work to understand consumers’ unmet needs and then try to figure out what are the products that fit those needs. But, that isn’t perfect because, for example, when Apple introduced the iPhone, they introduced a product that consumers didn’t even know they needed – that obviously became a gigantic success.

So, along with just trying to understand what our consumers’ unmet needs are, we are trying to understand what are their needs they don’t even know that they have.

At a high level, it really involves a lot of both quantitative and qualitative research.

With a ‘choice’ of either tackling pollution or directly investing in fighting other issues such as global warming – how should brands choose what to focus on?

With a ‘choice’ of either tackling pollution or directly investing in fighting other issues such as global warming – how should brands choose what to focus on?  Posted in: 33,Challenges- What should brands focus on regarding social issues?

Posted in: 33,Challenges- What should brands focus on regarding social issues?https://embed-ssl.wistia.com/deliveries/778b472e521bd13b475445e24c260513.mp4

There are a lot of potential opportunities out there. One thing that we do is make sure we’re pretty grounded in what people’s actual barriers are. We’ve identified two key barriers for consumers, and the first is what we like to think about as the input.

It’s the fact that sustainability can be overwhelming and confusing; even people who are pretty engaged with it are just confused with something as easy as recycling.

For instance, can I throw my wine bottle with my magazines or with a water bottle? Or do these have to be separated? There’s certainly a barrier on the input side of it, but then on the other side of the coin is the barrier in the output. This is an important one as well because even if people are dedicated and engaged and put in the time to figure out the ins and outs of what they can be doing, it’s often frustrating for people because they feel like the impact of this isn’t enough. “I’m just one human being.” “This is just one straw that I didn’t get with my ice coffee,” so it can feel like even the impact that we have isn’t meaningful enough in the whole big picture, so we look at both sides of this coin of these two key barriers as we’re trying to decide which issues to focus on.

How does social media influence brand perception compared to TV ads or other marketing channels?

How does social media influence brand perception compared to TV ads or other marketing channels?  Posted in: 17,Trends- Does social media impact brand perception differently?

Posted in: 17,Trends- Does social media impact brand perception differently?https://embed-ssl.wistia.com/deliveries/adfc4176ac04fabf79e0722a219f8086.mp4

We are only beginning to learn because Facebook is maybe 15 years old, relatively young, and it’s certainly evolving a lot as well – and we are learning how these interactions work. We can see how social media influences how people perceive, engage and interact with a brand. For me, it’s the first time that it is really coming together in a different way than in the past when social media marketing was more action-oriented. This is more brand-building oriented, and I think that we are at the very beginning of understanding it. The key now is how do you combine the stream of paid advertising content and user-generated content – importantly, how do you strike the right tone that all can become one.

Research that you are doing here is, for the first time, allowing us to understand how consumers interact and respond to the content.

For the first time, we are beginning to understand not only how it drives clicks and engagement but also brand awareness, brand understanding, and other things typical for TV advertising that now you can expect from this medium as well.

How should brands prepare for complex studies?

How should brands prepare for complex studies?  Posted in: 18,Tools- How should brands prepare for complex studies?

Posted in: 18,Tools- How should brands prepare for complex studies?https://embed-ssl.wistia.com/deliveries/13557119bf10f49700bb7fb94b97806a.mp4

The biggest thing is talking to a wide variety of stakeholders: working in our field teams, directly with our partners, corporate teams that design the corporate strategy, and the Go-to-market team. It can seem really disparate when you think about the complexity and what each of those individual teams is looking for.

So it’s really important when I’m designing a study that I understand each of those cohorts.

I want to learn more about what are the things they are thinking about this year or the next few months. So what I typically will do is write a research brief, and I’ll typically send that to each of the stakeholders as well, and make sure that I have alignment. Once I have it, that’s when I reach out to the vendor.

Getting everyone aligned not only helps me get a very clear and concise view of what I am looking for but also helps me ensure I have a good partnership with my vendors right off the gate.

Which tech solutions will be big in the upcoming years?

Which tech solutions will be big in the upcoming years? Posted in:

19,Trends- Which tech solution will be big soon?https://embed-ssl.wistia.com/deliveries/dcda62cf54ca79d8345a8e83d7689f76.mp4

We are constantly working on perfecting our abilities, whether adding features to our 3D studio and its huge database, building online solutions or fine-tuning eye tracking and facial coding algorithms.

We try to stay proactive and responsive to the needs of our clients in the NPD area. There are so many great applications of our solutions that are flexible and verifiable.

Still, I would say that clients like Twitter are setting new standards of quality research on social media, and it shows how important partnerships like ours are for doing brave and impactful things in insights.

What are some of the good examples of sustainable products improving consumer experience?

What are some of the good examples of sustainable products improving consumer experience?  Posted in: 32,Innovation- How can sustainable products improve consumer experience?

Posted in: 32,Innovation- How can sustainable products improve consumer experience?https://embed-ssl.wistia.com/deliveries/68a90fbd451db9f560ac107c2a3c3a0d.mp4

Sephora has done an excellent job of making it easy to shop and navigate. They have their ‘Clean by Sephora’ logo that’s easy to find in-store or if you’re online. It’s easy to click in and filter, and it gives you peace of mind that everything that’s labeled is eco-friendly and good for the planet. Thrive Market is another one that I often hear when I’m doing consumer interviews, as a place where people go just because it’s almost a mental shortcut. They know that if they’re buying from Thrive Market, it will be eco-friendly, not toxic, good for their bodies, and good for the world. Another example on the brand side is Ethique shampoo bars. They started as a solid shampoo, but now they’ve launched into other adjacent categories and waterless solutions.

From the moment you enter their website, their direct consumer experience online is clear and easy to navigate.

It’s in the very human and culturally relevant language. Then, when you get the product shipped home, they make the unboxing spirit fun. Some of the shampoo bars are heart-shaped, which is just a great thing to experience when you’re taking on a new sustainable product form. Finally, the product usage itself can be quite pleasant. That’s an example for me of a brand that’s gone above and beyond delivering on basic category benefits, like cleaning into an experience that actually surprises and delights people along the way.

What are some of the regional e-commerce differences you’ve encountered?

What are some of the regional e-commerce differences you’ve encountered?  Posted in: 44,Trends- What are the regional e-commerce differences?

Posted in: 44,Trends- What are the regional e-commerce differences?https://embed-ssl.wistia.com/deliveries/a391958c179d7b5f08aebb0966dfb03f.mp4

One of the big differences that I can see is the different brand landscapes and different types of emerging business models. For instance, in France, the main contributor is the drive – pick out in-store. In the ASEAN region, which is very different from one country to another, you have a big emergence of bricks and clicks. In Australia, 4-5 years ago, the market was at around 3-4% in e-commerce, and it is now slightly moving – and generating more than 10%. There has been a big shift with the emergence of online purchases, which can take various forms. Bricks and clicks have been developing themselves strongly towards e-commerce: in the Middle East, you have the appearance of players like aggregators – platforms that will connect the consumer with the closest store. But at the same time, lots of different players are emerging everywhere, and obviously, the strong presence of Alibaba Group in all South-East Asian countries and Amazon in the Middle East and Japan.

In this landscape, you cannot have a one-size-fits-all approach.

It is really about understanding the different environments, mapping the players, and learning the different patterns so you can build a strategy.

What is the first step to making a new sustainable product truly competitive?

What is the first step to making a new sustainable product truly competitive?  Posted in: 29,Challenges- How to start making new competitive sustainable products?

Posted in: 29,Challenges- How to start making new competitive sustainable products?https://embed-ssl.wistia.com/deliveries/a49b34de41db4a2c02945e5b4800c258.mp4

The most important step is to fully understand the job to be done with the product. At the end of the day, a product has to work, or people won’t use it – even if it’s the most sustainable option. An example we have is the Colgate toothbrush. It’s called Colgate Keep. It’s called that way because you keep the handle, and you only change out the brush head, so it’s a great solution for a manual toothbrush where you’re using 80% less plastic because you keep the aluminum handle forever. But again, we had to really make sure that the product performs as somebody would expect a normal toothbrush to perform – so we did a lot of work on the brush head to make sure the performance was there. We really had to make sure that it delivered on cleaning and a comfortable experience. Then we talked about sustainability as an added benefit.

That’s one thing that we’ve learned – leaning fully on sustainability isn’t enough. It might drive novelty and trial, but it’s not enough to drive repeat.

You really need to fulfill a consumer’s job to be done in order to continue them on in the process.

What is the relationship between insights gained from consumer research and those obtained from passive data?

What is the relationship between insights gained from consumer research and those obtained from passive data?  Posted in: 30,Innovation- How do consumer insights and passive data compare?

Posted in: 30,Innovation- How do consumer insights and passive data compare?https://embed-ssl.wistia.com/deliveries/610912aad845081d56d4a90122304031.mp4

There are two different types of data: primary research data and the data that we have from our own system, from the funnel conversion, etc.

Magic happens when you marry both those data sets, but it is easier said than done.

As researchers, we tend to get very academic about it a lot of times, and we want to do it in a proper way. But what’s the purpose of doing it in the first place, right? The purpose of doing it in the first place is to generate some actionable insights or some action or initiative which essentially moves certain KPIs.

At the end of the day, you are pushing the envelope in terms of getting that additional data or pulling people’s loyalty or motivation. That’s the name of the game at the end of the day.

How can brands take on comprehensive projects in areas that are a bit underexplored in comparison to packaging or ads?

How can brands take on comprehensive projects in areas that are a bit underexplored in comparison to packaging or ads?  Posted in: 31,Tools- How can brands conduct projects in underexplored areas?

Posted in: 31,Tools- How can brands conduct projects in underexplored areas?https://embed-ssl.wistia.com/deliveries/6b895edffcb9bbcc76293b35f1ae4014.mp4

In any complex study, the organization is key, of course. But I think it’s also important to know that ingoing hypotheses are just that – hypotheses.

As researchers, we need to remember to take a step back and let the consumer data tell us the story.

It sounds trite, but we represent the voice of the consumer. Of course, we need to add the layer of our research and business expertise to the consumer’s voice for our stakeholders, but the basis of what we do is consumer-led insights.

Ensuring we’ve done due diligence in setting up complex studies in areas of discovery or during times of discovery is critical – garbage in, garbage out – and that may mean a couple of extra steps. Things like desk research, talking with counterparts in other countries or categories, connecting dots from other research initiatives are all ways we make sure we’re at the top of our game at EyeSee to help our clients navigate complexity.

E-commerce is different from FMCG, but while it is sometimes more complex than packaging, it is at least as exciting. And with solutions such as the online path to purchase, we simplify that complexity for our clients and their stakeholders.

How does Colgate navigate all these different aspects of sustainability – beyond just products/packs, but across the production process and the entire business?

How does Colgate navigate all these different aspects of sustainability – beyond just products/packs, but across the production process and the entire business?  Posted in: 43,Challenges- How does Colgate-Palmolive navigate the entire production process?

Posted in: 43,Challenges- How does Colgate-Palmolive navigate the entire production process?https://embed-ssl.wistia.com/deliveries/8f8e8f30d59de63ca17c682073dd94c0.mp4

That question has become so much more complex even in the last few years. I think we take a very cognizant approach to peeling back the onion. One of the things we’ve done internally is that we really focused on greater collaboration and conversation between the different groups to make sure that we’re not operating silos. For instance, we have consistent forums where we have people come together across our functions that are focused on sustainability, whether that’s marketing or supply chain, finance, legal procurement. We really want to make sure that we use those forums to surface any opportunities and challenges.

It’s just a great way to think about our pipeline and how we keep sustainability integrated into the everyday fabric of the business.

The second thing we do more externally is keeping a pulse on where consumers are at, especially through COVID-19, but certainly, beyond as well – thinking about how people’s perceptions of sustainability have changed and how they’re evolving, and what people’s behaviors and challenges and what’s on their radar screen.

What are the 4 types of shoppers in FMCG?

What are the 4 types of shoppers in FMCG?  Posted in: 41,Trends- What are the 4 types of shoppers in FMCG?

Posted in: 41,Trends- What are the 4 types of shoppers in FMCG?https://embed-ssl.wistia.com/deliveries/e2054c214525a6deccfe8914490032d6.mp4

There is a simple but effective framework we devised for interpreting the results and identifying consumer segments. Based on our tests, we realized that there are 4 types of shoppers when it comes to brand loyalty.

The first group are the instant switchers who abandon the brands immediately after the 1st round of shopping in the out-of-stock exercise and don’t pick the brand in the later steps. The second group are the switchers, who abandon the brand between the 2nd and 5th shopping exercise and don’t return to the brand by the end of it. We call the third group the risky ones – they abandon the brand at some point but come back to their initial choice in 5th attempt. And finally, the fourth group are the loyal shoppers – they are consistently buying the same brand in all the out-of-stock exercises.

When you know how the sample spreads across each of these 4 types of consumers, you can start to think about how to assist their shopping

and ensure your brand is not ignored due to a bad planogram or that you have a chance as a replacement for your competitor, and from where do these buyers come, what triggers them to make the switch. It very clearly ranks consumer priorities – if a shelf is not executed properly, it is frustrating and can affect sales.

What is your philosophy about trying new approaches to understanding how users interact with you?

What is your philosophy about trying new approaches to understanding how users interact with you?  Posted in: 42,Innovation- What is your philosophy about trying new approaches?

Posted in: 42,Innovation- What is your philosophy about trying new approaches?https://embed-ssl.wistia.com/deliveries/a9c22c9fa7b8dc95e5620c87bbba3ec9.mp4

Innovation is just inherent in our culture. We are expected to innovate, and we have innovation budgets to use. The other challenge in doing innovative research is that stakeholders usually pay for the majority of the research, and I have to execute it. So with that, they hold their money in their budget very sacred – what that means is that it’s a lot easier to rinse and repeat. If you’re doing something more innovative, it is scarier, and you are taking a lot bigger risk. It is not just a risk of the stakeholder and me, but also of the business and all retail partnerships that we have – there is a lot at stake. So I really gauge how to approach innovation based on whether or not my stakeholder really wants to play and try new things or if they are a little more apprehensive. I will typically start with something more comfortable but then push the boundaries. So, for example, it’s a lot easier to say we’re making a quantitative approach with this study. We do those all the time, but if we do this quantitative study, we push this other little piece on top of it; it unlocks a whole different area. Are we willing to try that?

So I am just ticking away at those things and building on what’s comfortable, but always thinking a couple of steps ahead of what the stakeholder’s needs.

I think that’s where you get a nice secret sauce.