https://embed-ssl.wistia.com/deliveries/c2f8de2451b4ac71483f5346465ac3d0.mp4

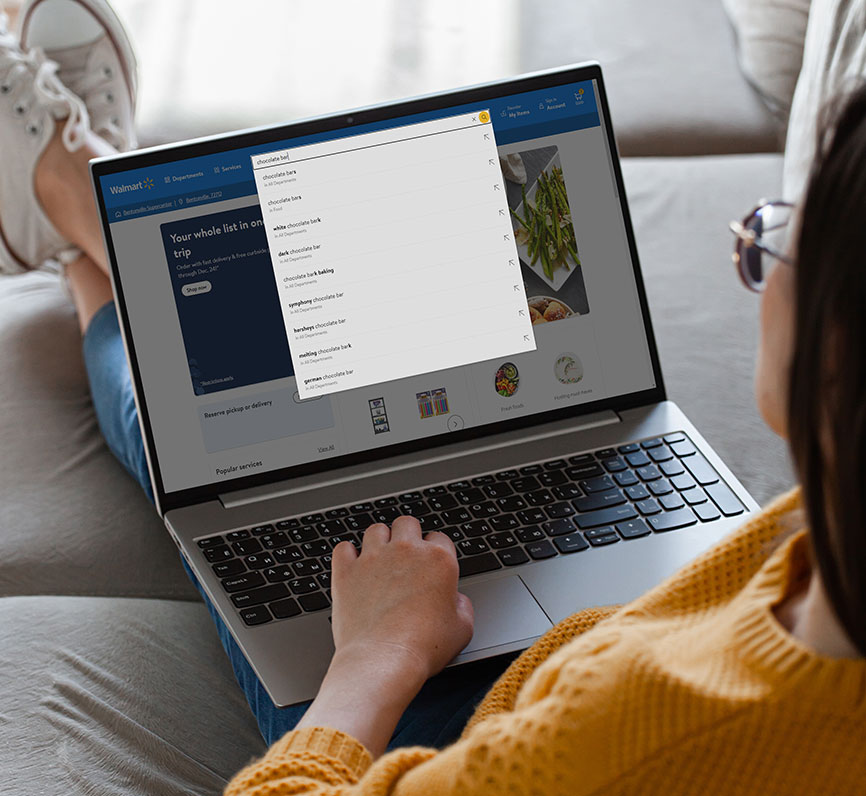

The majority of the client questions can be summed up into three topics: the first and the broadest is the situation when the client knows a lot about brick-and-mortar shopping but wants to know more about online shopping patterns for the specific category. The second topic is more concerned with the client’s product presentation on the retailer website – can shoppers find the particular product? The last category refers to more specific and tactical questions that focus on the product performance once certain changes are implemented. When we explore how the category is bought online, we start with our navigation tracking approach: this tool unravels the spontaneous behavior on the retailer’s website.

As for the product presentation on a retailer website, usually meaning its visibility and overall findability, we use a combination of methods.

We use both navigation, eye and interaction tracking – navigation helps us uncover how much time and effort shoppers invest in finding a particular product that usually clients want. Eye tracking gives us an additional perspective on how noticeable that product is on the retailer’s list. When it comes to more specific questions, considering the impact of different optimizations, we rely on the eye and interaction tracking that identifies key conversion triggers in this optimized context – how each of these introduced features affects a purchase intent and to what extent.